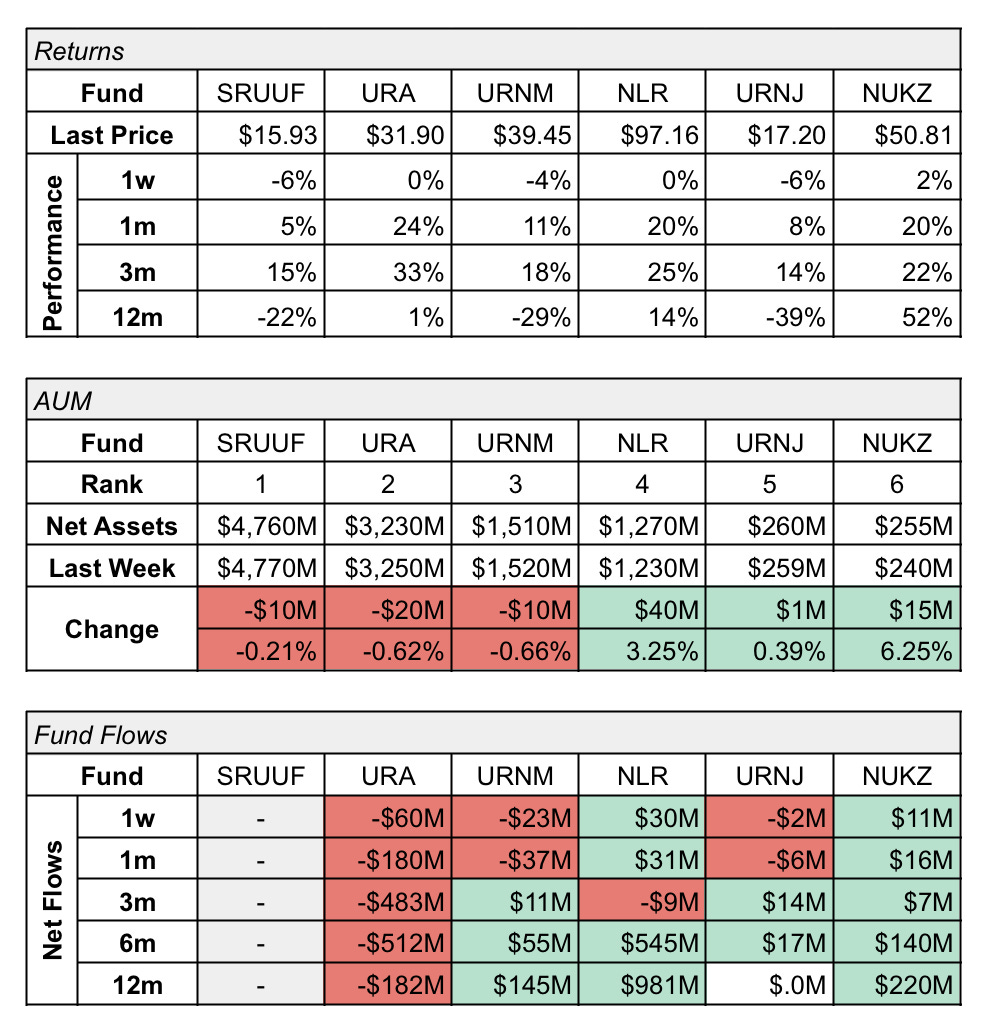

Data for the trackers is pulled from ETF.com and Google Finance. Paid subscribers enjoy an additional tracker in the bi-weekly to see how AUM has been trending over the trailing 12 weeks, as well as some graphs to compare which funds are outpacing the herd.

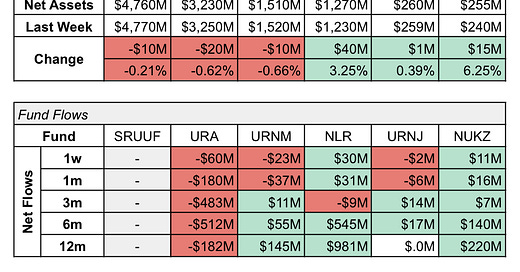

A significant picture was painted by the net flows last week. The nuclear renaissance was announced as loud as possible by the EOs, and the market responded by pulling $85 million from uranium and uranium-heavy funds. At the same time, investors jumped into nuclear and nuclear-heavy funds to the tune of $41 million.

By the end of June, the AUM of NUKZ will likely be higher than URNJ.

By the end of 2025, the AUM of NLR will likely be higher than URNM.