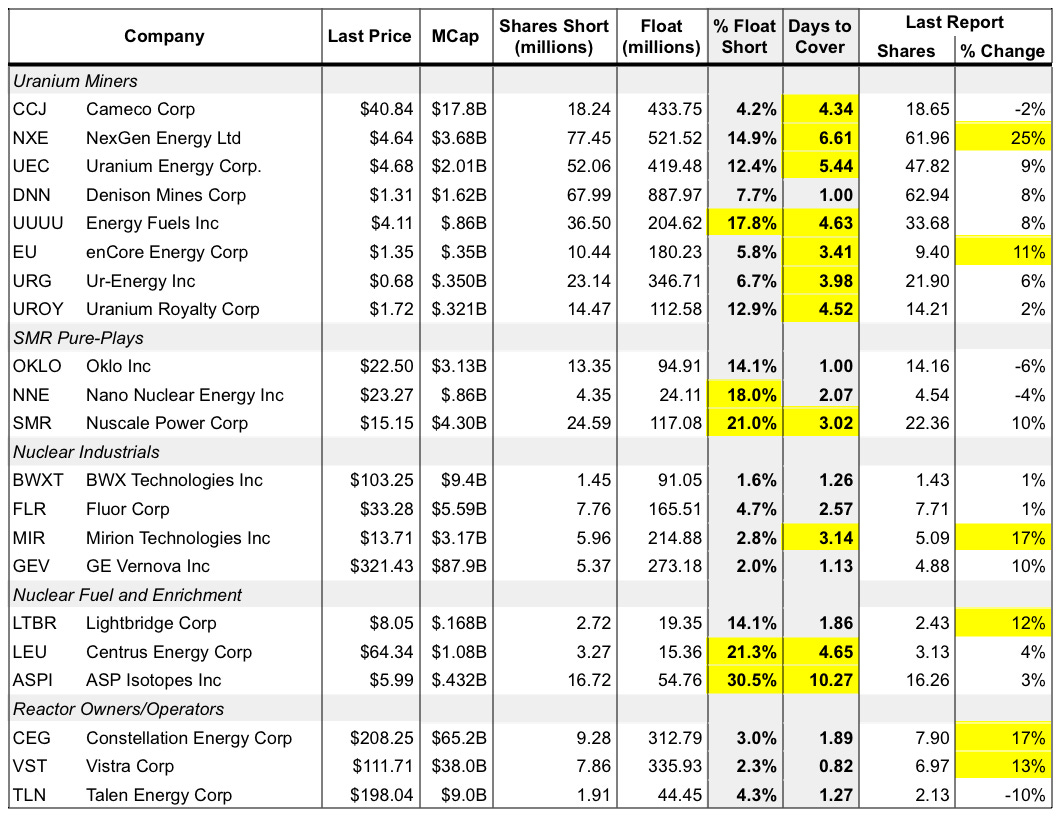

Data reflects shares sold short as of March 31st. Data for April 15th will be released April 25th. Our short report is usually released a couple business days after the data release day, dependent on the speed of website updates.

Notables

% Float Short: $UUUU $NNE $SMR $LEU $ASPI

Days to Cover: $CCJ $NXE $UEC $UUUU $EU $URG $UROY $SMR $MIR $LEU $ASPI

Changes: $NXE $EU $MIR $LTBR $CEG $VST

No Notable Data Points: $DNN $OKLO $BWXT $FLR $TLN

Takeaways

Miners - The shorts are still showing no signs of fear with the high DTC of their positions, and the fearlessness is matched by the shorting action on the ASX where the top three most shorted stocks on the exchange are all uranium miners

SMRs - While the % of float is high for all three, the DTC is manageable enough for OKLO and NNE. SMR is interesting though. They had language in their recent quarterly earnings that pointed to a potential new construction announcement coming soon. Should this actually happen, there could be a squeeze

Industrials - FLR and MIR have high DTCs, both also abnormal like SMR. FLR is predesignated as the manager for the next NuScale project, which could come soon with a multi-billion dollar contract for Fluor. MIR is benefiting as a provider of equipment for new and upgraded reactors, which are being announced constantly on the global stage. MIR also had a knockout annual earnings report, but short interest from two months ago is still up over 50%

Fuel Chain - Sellers are apparently anticipating a pull back from the recent run up in price for LTBR. The large short position in LEU does not make sense, given if the Russia-Ukraine war gives any sign of ending, the export restrictions Russia has on enriched uranium will then be anticipated to end, which will significantly benefit Centrus. ASPI has enjoyed a string of positive news from their isotope enrichment progress, which has sent the stock up significantly over the past month. Regardless, shares sold short are up over 120% for ASPI over the last 10 weeks, a sign that sellers anticipate the success will not last. Over 10 DTC is disturbing though, and an insane short squeeze could occur should even slightly positive news be released

Utilities - Over the last couple months, CEG seems to be catching more of the short attention, while VST and TLN have been mostly flat in terms of total shares sold short. A rise in short interest for VST and CEG for the end of March, but nothing significant