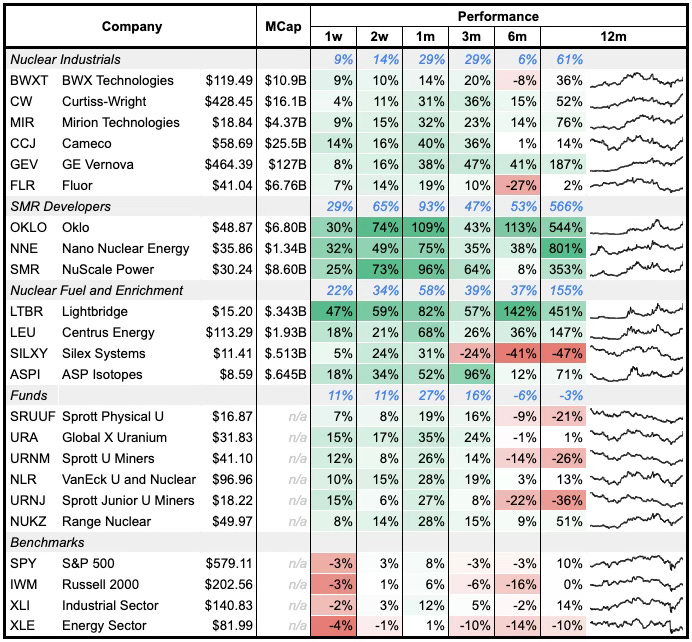

Nuclear explodes, in the best way

Bi-weekly newsletter discussing nuclear sector returns, earnings, and news

Executive Orders announcing the start of the nuclear renaissance, earnings breakdowns for NNE and ASPI, and so much news about multiple countries turning extremely bullish on nuclear energy.

The Executive Orders

News, unquestionably, has to come first for this letter. Dozens of articles have already been written on the executive orders (EOs) summarizing some of the main points. We will be skipping the lengthy discussion that could be had on the contents of all five of the EOs and instead focus on how this impacts the companies we track. For those of you looking to read through the more encompassing discussions on the EOs, we recommend Doomberg's Actuarial Examinations and Alexander C. Kaufman’s 13 takeaways from Trump's executive orders on nuclear power.

We released an article earlier this weekend covering the EO related to the fuel chain participants. In summary, BWXT and Centrus Energy stand to benefit the most from potential near term funding for rapidly increasing enrichment capacity and conversion capacity. It remains to be seen if the other "not as domestic" enrichment companies, such as SILXY, will benefit the same amount.

Two other major directives are worth highlighting here. The first is the order for the NRC to reduce the 4+ year licensing review process down to a maximum of 18 months. This is an earth-shattering change for the NRC to undertake. There are multiple individual steps in the current process that take over two years themselves. Much speculation has been shared about how the NRC will attempt to accomplish this reduction, especially with the EOs pointing to the potential reduction in manpower at the agency as well. This licensing review time can also be assumed to pass on to the reviews for enrichment and fabrication companies as well. The second is the directive to have 10 large reactors under construction by 2030. If the US can manage this, or even just a couple reactors, reinvigoration of the supply chain could potentially send the nuclear industrial stocks through the roof. The other factor to consider - companies that currently get a tiny portion of their revenue from nuclear, but could see rapid expansion of that respective line of business should the industry take off.