Reactor licensing overhaul and the new “nuclear adjacents”

Bi-weekly newsletter discussing nuclear sector returns, earnings, and news

Headlines were everywhere these past two weeks, but surprisingly did not move to the sector as much as one would anticipate. In particular, there were significant regulation changes with regards to NEPA, NRC hourly fees, and NRC review timelines. Some names also saw indirectly related headlines that could be major catalysts for upcoming earnings reports.

Major addition to the bi-weekly

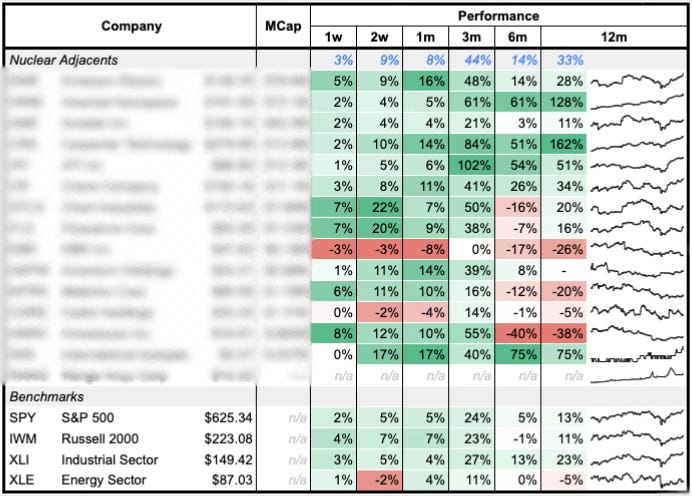

Starting with this report, we will be tracking a significant number of “nuclear adjacent” companies. We touched on some of them in the last issue, but with some more digging we’ve recently performed, there are a number of additional opportunities we have discovered that are worth tracking more formally in the bi-weekly. Some of them have a long way to go before they see any real boost from the nuclear sector, but some of them could see stock price influence as early as the next two quarters.

Our tracker currently stands at 15 tickers, with companies ranging from large-cap industrial to micro-cap construction. We look forward to tracking some of the catalysts that are in the future for these companies and sharing them with our paid subscribers.